How We Saved Up During the Pandemic : Last eat out with friends pre-pandemic lockdowns (March 2020)

The staying at home for two years or so saved us some money. It’s probably more than what we can save up in a pre-pandemic year. Understandably, the protocols on staying home changed our spending habits, with restrictions in place, going out has been less, thus, eating out, buying apparel, and even purchasing tickets for museums and concerts were less to nil.

Travel to other countries were also restricted. What money we used to go on summer breaks spent on hotels, plane tickets, food out, souvenirs, museums, and shows were kept in our adventure fund box.

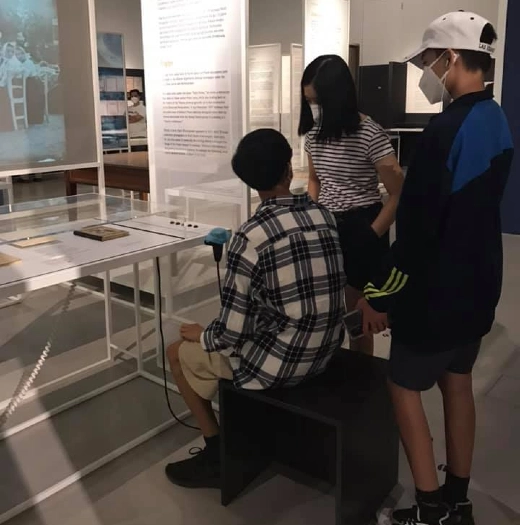

How We Saved Up During the Pandemic : Free museum when lockdown was lifted

Table of Contents

Money Flow

What made us save up the last two years? It might be obvious to many, but let’s list down ways how we saved up during the pandemic anyway.

Unused Allowances

Starting from age 14, the kids each have their own debit account, a free account for kids aged less 21. I decided on this to make sure that they have money stashed when emergencies arise. Like when they need money for taxi, snack money for school, and when going out with friends.

I’ve set a certain amount of money that is automatically sent to their accounts every Monday, as it’s meant to be a weekly budget.

Since being homeschooled, the money sent to their accounts were untouched, accumulating to a hefty amount by the end of lockdowns.

Less on Gas

Staying at home doesn’t mean though that we weren’t allowed to go out at the park, or open spaces. But we usually just walk to somewhere near or go by public transportation if doable. For those with cars, many saved up on gas (although today’s gas prices might mean spending that money now).

Less Eating Out

Sundays are often eat-out days for us, for the family, or with friends. Since the lockdowns, we rarely got the chance to eat out, as most of the restaurants were only open for take out, and we would meet up where we can walk a lot (open spaces), so we only would have bubble teas or take out food. Less $ too since they’re not proper meals, but just snacks.

How We Saved Up During the Pandemic : Less Eating Out

Less New Apparel

Staying home means donning lounge wear mostly. We only get dressed on special zoom meetings, and we still have a lot of unused items in our dressers. Same for shoes, only going out once in a while means less shoe friction, and more life to them. Although stacking or not using the shoes can actually break them.

Less Travels

Travels to other countries were sadly on a halt too. Airports around the world closed for leisure travel to stop the spread of the virus. We did visit nearby lakes and towns, but by trains, buses, which is economically cheaper than plane rides.

Along with less travels comes less expenses – no hotels, no expensive restaurants to try local cuisines on other cities. Just saving up for when travel will be lax again.

How We Saved Up During the Pandemic : last trip pre-pandemic

Meal Plans

We subscribed to a meal delivery service to save up on $. The concept is, to portion out the ingredients one needs to feed a number of people, and you get your food boxes depending on the number of days and meals you subscribed for. This reduces food wastes as you get the exact grams of meat, the exact cloves of garlic, the exact ml of soy sauce in a packet needed to cook a dish. We get to try new recipes too, and get to love and enjoy food more.

Set your Kids Up for a Bright Financial Future

Now if you have extra money, you can leave it as is – in their bank accounts or probably use it to grow so that there’s something to take out in times of trouble. The Bible says money helps with a lot of things, “Bread is made for laughter, and wine makes life enjoyable; but money answers every need.” (Ecclesiastes 10:19) Acknowledging that money is helpful, it also advises us to keep or save something each week, “On the first day of every week, each of you should set something aside according to his own means…” (1 Corinthians 16:1, 2)

The best time to teach your kids financial responsibility should have been 5 years ago, the second best time is now. Investment is the umbrella term used when you use your money to purchase an asset to attain an increase in value (return) over a period of time. There are many strategies, types/ways to invest and each even have different subcategories. Here are four that are easy to commit to.

How We Saved Up During the Pandemic : Adventure Fund Savings Box

Savings/Cash

If you simply want your kids to learn how to save, and where they can easily take some of their money when needed, get them a piggybank or an adventure fund box to keep their money in. A fund box (see photo) with glass can also keep one motivated to put in money, seeing the amount of notes inside growing in number.

Banks have always been where people save their money. There are however a lot of ways to save your money where you earn a little interest more than the banks.

More on these later.

College Fund

A college fund is a savings plan meant to help pay for education. It is best started when a child is born, as your money will have more time to grow and compound as with other investments or savings scheme. To plan, Savingscalculator.org allows you to calculate compounding interest for such college savings. The website helps you to quantify how much money there will be in a span of several years. There are factors you need to consider before availing a policy, it is best to ask a trusted financial advisor for help.

Real Estate

For those 18 and above, there are a number of real estate investment options. Real Estate Investment Trust (REITs), for example, pool capital of numerous investors to develop properties (e.g. hotel, apartment complexes, office buildings). Investors in turn become shareholders receiving dividends once the project is finished. One can invest as low as $1000.

Another simple real estate investment option for younger people would be buying smaller apartment units to rent on Airbnb and other similar services.

How We Saved Up During the Pandemic : Less New Apparel, Either dad or mom loves Kobe or his shoes…

ETFs and Other Assets

Exchange Traded Fund (ETF), simply put, is hybrid investments, diverse as mutual funds but easy to trade like stocks. It is a low-cost way for investors (you included) to buy stocks or bonds thru pooled investment funds at once. For example, you can open a brokerage account on Charles Schwab. You’ll need a brokerage account to buy and sell securities like ETFs or stocks and earn returns/dividends.

Brokerage accounts require a certain age to register, so make sure that you or your kids are compliant. We recommend to research the market and learn about mutual funds, stocks, ETFs before diving in.

You can decide in which you would invest in or ask an experienced trader for pointers.

Whatever you decide on to do with your saved money, remember that there are risks involved. But whatever happens, you can always earn it again.

Lastly, the bible reminds us that those who care more about people than they do about money are happier overall. “So, having food and clothing, we will be content with these things.” (1 Timothy 6:8) Contentment is the key, but learning to manage your money will save you headaches later on.

It’s always nice to save! I always try to put money back so we can travel in the summer.

Travel is a good investment too!

Great way to teach the kids to learn to save. We all need money all during our lives and being older in life, money is more important than ever.

Yeah, money helps with many things!

I love being able to save up whenever I can. I honestly hate spending money, so I’m pretty good about saving. My husband and I normally save some up so that we can take vacations with the kids.

Same, we travel with the kids to add to their memory banks!

I did save money during 2020 in some places like food and travel. I did also splurge on a hot tub.

A hot tub is not bad, in fact it’s worth spending on! ^_^

I think this was one of the few silver linings of the pandemic. There were a lot of accrued savings which needs to be wisely planned for.

Yes, it also made us slow down, and made us think, appreciate moments.

I love being able to save money and then use it for a fun trip. This is a great way to make sure your hard work pays off.

Such great tips and ideas for saving! I love it! Thank you for sharing your journey!

Being frugal and living within our means is such a great way for building up funds to save for the more important expenses or bigger better things!

I thought we were the only ones who did this during the Pandemic. I was amazed at all we had saved since being at home and it was a good way to share with the kids about learning how to save money.

It’s great when we have a boost to our savings. I use extra money to pay off any debts first.

Less travel saved us a bundle too. I’d rather be traveling though. 😉

This is a really great and very informative post! These are all really great tips to know thanks for sharing this with us!

All what we saved during pandemics , we are spending now in trips. We are willing to see the world!

The pandemic was awful but it helped us save a lot of money too. We invested in a new house